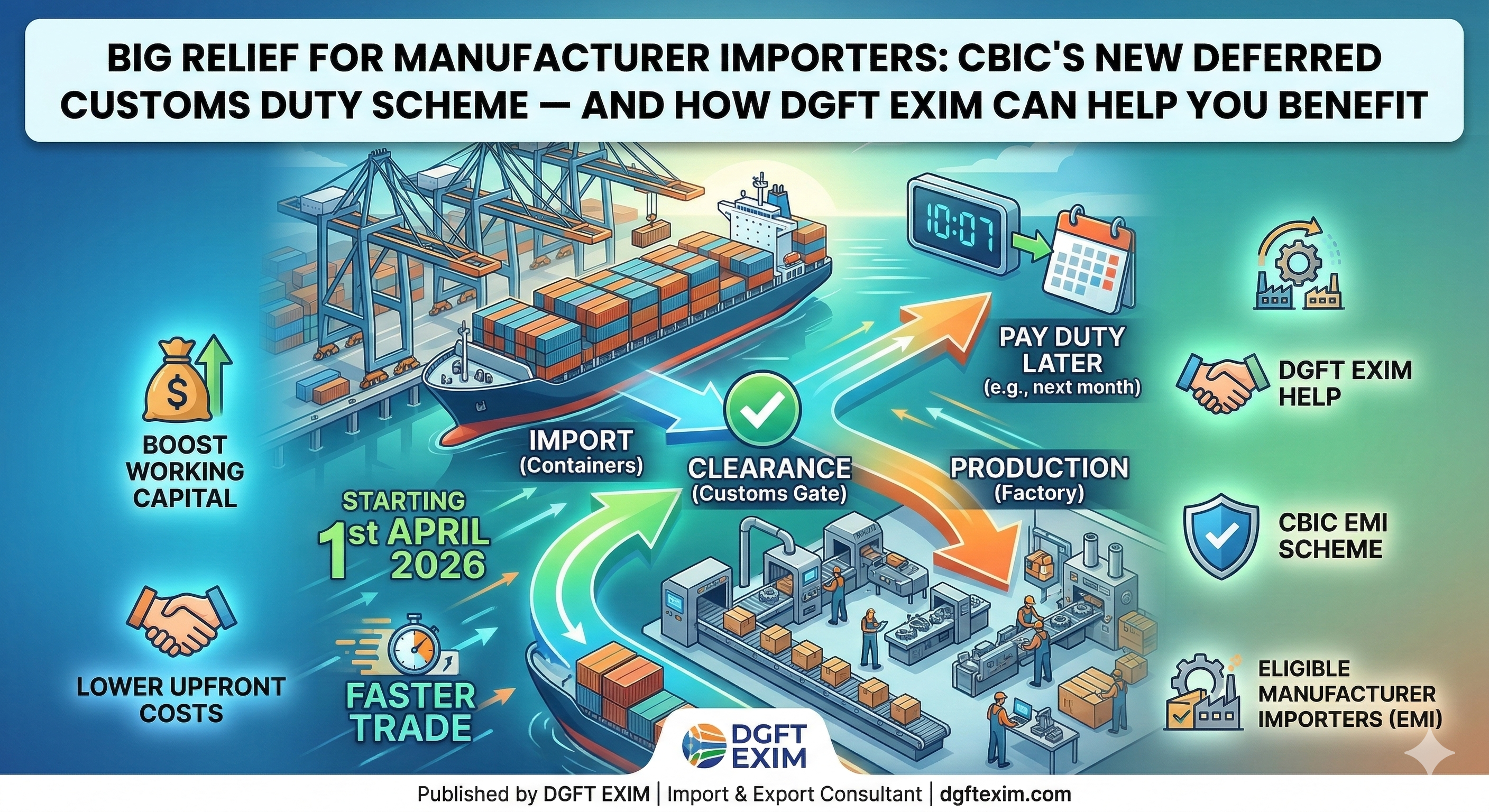

Big Relief for Manufacturer Importers: CBIC's New Deferred Customs Duty Scheme — And How DGFT EXIM Can Help You Benefit

If you're a manufacturer who regularly imports raw materials, capital goods, or components, here's news that could significantly ease your cash flow — starting 1st April 2026.

The Central Board of Indirect Taxes & Customs (CBIC) has issued Circular No. 08/2026-Customs dated 28th February 2026, extending the facility of Deferred Payment of Customs Import Duty to a new category called Eligible Manufacturer Importers (EMI). This means qualifying businesses can now clear their imported goods at the port without paying customs duty upfront — and settle it later, within the same month.

This is a landmark move for Indian manufacturers, especially MSMEs, and at DGFTEXIM, we're already helping businesses understand, assess, and apply for this facility.